Don’t Let BARRIERS Stand In Your Way Of Getting It Done

·

8 minute read

·

Barriers. Set up to stop people. Some.

One of the questions I still get asked about being an entrepreneur deals with the fundraising process. “As a woman, was it more difficult to raise money when you were starting Hint?”

A barrier set up to stop some. But not all.

I still don’t know how to answer that question, by the way, because I have never been a man and I don’t know if fundraising would be easier if my gender was different. I could guess at that, but why even allow that thought to get in my way?

You see, breaking down barriers really boils down to this for me. I wasn’t going to let anything get in the way of raising money and building my company. And even when people shared that it might be harder to raise money as a women, I was determined to not allow that to get in my way of getting it done. Even if that meant having more meetings. More pitches. More “No”s. Eventually, a “Yes.”

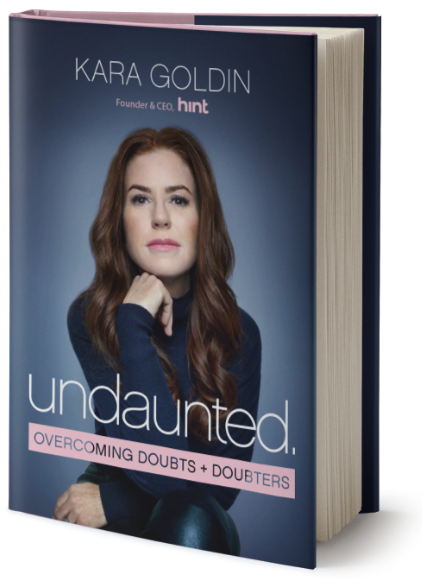

I spent a lot of time thinking about this topic when I was writing my book, Undaunted: Overcoming Doubts and Doubters. When you focus on what you can’t do versus what you can do, you psych yourself out. You have to believe in yourself and your idea before others will. And you have to be committed to getting it done. Do what it takes. Really. Otherwise, it isn’t even worth trying to raise money at all. Stop allowing doubt or any reasons for not being able to do what you want get in your way. Fundraising is hard no matter your circumstance. You just need to find a way to accomplish what you want to.

But in order to accomplish what you want, and in this case raise that money, you need to lay the ground work. When I was starting Hint, I used my savings to create my first products that I could take to market. I chose to use my savings versus trying to raise from friends and family because I wanted to see if my idea for an unsweetened flavored water was what consumers wanted to purchase before I asked others to invest in my idea. While that isn’t the way all startups begin, I do believe that you are more likely to get that seed round done – and at a higher valuation – if you have a product and some early sales under your belt. Without those sales to show, it’s likely that it could be like a bad episode of “Shark Tank,” where an incredibly large chunk of your business is given away in equity before you even get started.

Keeping your costs down, especially in those early days, is smart. Until you can justify hiring people, be willing to wear multiple hats. While you are proving that consumers or businesses want what you are selling, you are showing that you got traction on a prudent budget. And finally, when you are finally ready to pitch to investors, having a story to share showing what could have been done with more resources is effective. Identify how their investment creates bigger progress.

Oh the early days of Hint. When we were storing pallets of Hint in my garage and delivering product to stores out of the back of my Jeep. Good times. There are so many reasons this ultimately worked to my advantage, though. Me, the founder, selling and delivering those cases myself. Showing that you are willing to make it happen. This is definitely often a necessity in the beginning. And being able to witness the reactions to your product – gold.

Your ability to get feedback from your customers is key, whether it is the buyer at the grocery store or the customer who buys your product. Those emails and phone calls from customers allowed me to understand desired flavors of Hint as well as suggestions for stores to get my product into. Also, hearing directly from customers their own reason for buying Hint. Learning how Hint was helping consumers get through their own health challenges, like diabetes or getting rid of the metallic taste from chemotherapy during cancer treatments, was educational. But also motivating to hear, understanding that the product I created was helping people attain health. And that feedback was also the kind of feedback that I was able to use in the pitches that I was soon making to investors.

Eventually, with a bit of seed money, I was able to invest in my first hires — salespeople. Bring in the revenue. Then, a contract bookkeeper to make sure that we had our books in order from very early on. Having done both of these roles prior to hiring others to take over was super helpful. Even when I hired people to take on the roles that I once performed, I made sure to stay involved enough to know what they were doing. Always being able to jump in and be helpful when necessary is never a bad thing.

Which brings me to another important opinion I have about raising capital. So many entrepreneurs make this critical mistake early on. They think they need to raise as much money as possible because that’s what everyone does. But there are other options. Like doing a round with angel investors – friends and family and customers who love your product. Consider doing the investment too as a convertible note so that the investment doesn’t get priced until the next round. Remember, don’t focus too heavily on that big, eight-figure valuation. Focus instead on getting the right investors and continuing to move sales forward.

AI and blockchain entrepreneur Manuj Aggarwal often talks about the need to fundraiseas one of his “big myths” of entrepreneurship. He was a guest on my podcast The Kara Goldin Show recently, where he discussed strategies for raising capital when you’re just starting out. “Convincing somebody to give you money for an idea is 10 times harder than selling a product,” he noted. “Because when you’re selling a product, you’re giving something back in value.” And once you’ve built a loyal customer base – even if it’s small – you’ve now proven the value of your product unequivocally. “It actually becomes 10 times easier to find an investor now, because the investor sees that you have traction and their investment is going to grow.”

Another one of my podcast guests, Joel Clark and Cameron Smith of Kodiak Cakes learned the importance of waiting for an investment and taking their time to grow. By the time they were ready to fundraise years later, they decided to try getting an investment on “Shark Tank.” Two of the judges wanted a 50% share of the business in exchange for a relatively small investment of half a million dollars. Joel recalled the experience on my podcast, “It’s a hard thing for entrepreneurs to sign up for – giving away part of your business can feel like giving away part of your child to someone.” The duo ended up walking away from either deal and waited a few more years before deciding to take funding.

Letting barriers stand in the way of meeting your objective won’t allow you to succeed. The most essential question an entrepreneur should ask themselves when facing these barriers is, “What else can be done?” Allowing phrases like, “I can’t do something” or “I won’t be able to do something” or “That’s impossible,” get in the way of making it happen, is silly. Allow your resilience to kick in and find a way.

Undaunted

Get Kara’s Insights In Your Inbox